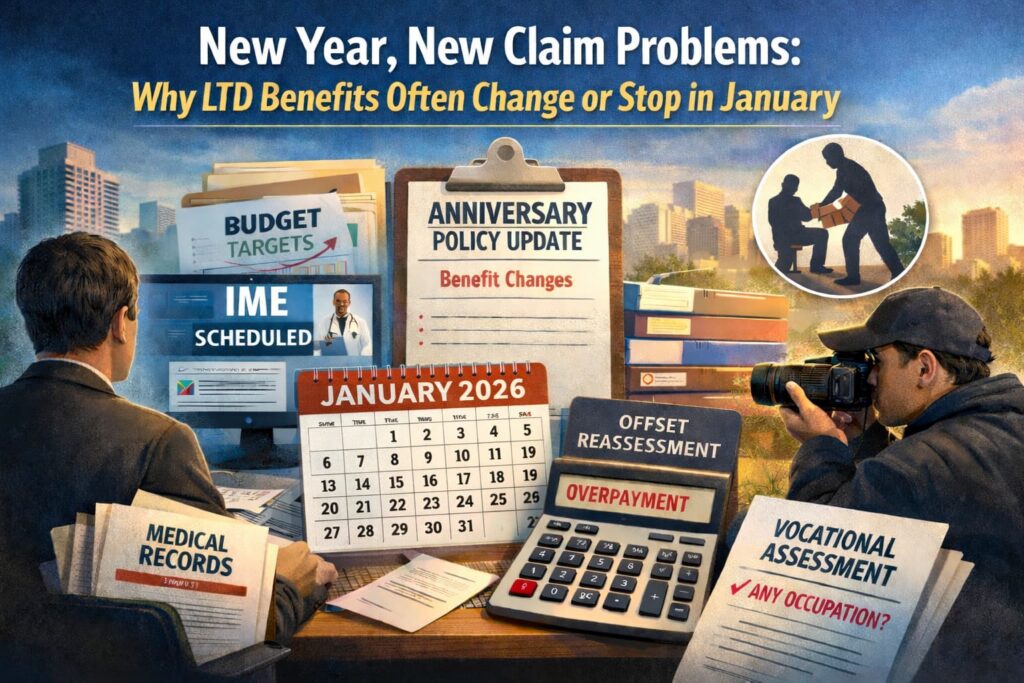

For many long-term disability (LTD) claimants, the new year brings unwelcome surprises: benefits that suddenly stop, payments that unexpectedly decrease, or demands for extensive new documentation. If you’re experiencing these issues, you’re not alone—and it’s not a coincidence.

Why January? The Annual Reevaluation Cycle

Insurance carriers operate on annual cycles that align with the calendar year. January marks the beginning of new fiscal planning, updated claim reserves, and revised operational goals. For disability claimants, this means several things happen simultaneously:

Budget Pressures and Performance Metrics

Carriers set annual targets for claim closure rates and benefit payouts. Adjusters often face increased pressure in January to reduce claim reserves and meet performance goals for the coming year.

Policy Anniversary Dates

Many group LTD policies have January effective dates, meaning policy terms, benefit calculations, and coverage provisions may change at the start of the year.

Offset Recalculations

If you receive Social Security Disability Insurance (SSDI), workers’ compensation, pension benefits, or other income, your LTD carrier likely reduces your benefit payment by these “offsets.”

The “Own Occupation” to “Any Occupation” Transition

Many LTD policies provide benefits for an initial period (typically 24 months) if you cannot perform your “own occupation,” then switch to a stricter “any occupation” standard.

Common January Claim Problems

Based on our extensive experience representing disability claimants throughout California and nationwide, here are the most common problems that emerge in January:

1. Sudden Requests for Comprehensive Medical Updates

Even if you’ve been providing regular medical updates, carriers often demand extensive new documentation in January. You may receive requests for:

- Complete medical records from all treating physicians for the past year

- New functional capacity evaluations

- Updated diagnostic testing

- Detailed daily activity logs

- Employer job descriptions and vocational assessments

While some documentation requests are reasonable, carriers sometimes use January reviews to overwhelm claimants with paperwork, hoping that incomplete responses will justify benefit terminations.

2. Independent Medical Examinations (IMEs)

January sees a spike in IME requests. Carriers schedule claimants for examinations with physicians they select and pay—doctors who have never treated you and who may spend only 30 to 60 minutes evaluating complex medical conditions. These “independent” examiners often reach conclusions that contradict your treating physicians’ opinions, providing carriers with justification to deny or terminate benefits.

IMEs are particularly problematic because they typically occur on a single day and capture a snapshot that may not reflect your true functional limitations. If you have conditions that fluctuate or worsen with exertion, a brief examination may not reveal the full extent of your disability.

3. Increased Surveillance Activities

Surveillance often intensifies in January. Carriers hire private investigators to conduct video surveillance of claimants, monitor social media accounts, and document activities that might suggest you’re more functional than your medical records indicate.

A short video clip of you carrying groceries, playing with your children, or doing yard work can be taken out of context and used to argue that you’re capable of working—even if those activities caused significant pain or required days of recovery afterward. Carriers know that people tend to be more active during holiday gatherings and early-year activities, making January an opportune time for surveillance.

4. Offset Calculation Disputes

If you receive SSDI benefits, your LTD carrier reduces your monthly payment by your SSDI amount (and often by your dependents’ benefits as well). In January, carriers systematically review these calculations and frequently claim that overpayments occurred in the previous year.

You may receive a letter stating that you owe thousands of dollars in overpayments, with the carrier demanding immediate repayment or announcing they’ll withhold future benefits until the alleged debt is satisfied. These offset disputes often arise from miscommunication, outdated information, or the carrier’s failure to properly credit prior offset amounts.

5. Vocational Assessments and “Any Occupation” Denials

When your claim reaches the “any occupation” phase—typically after 24 months—carriers often schedule vocational evaluations in January. Vocational consultants hired by the carrier review your medical restrictions, education, work history, and transferable skills to identify jobs they claim you can perform.

These assessments frequently identify sedentary or light-duty jobs that exist in the national economy but may be entirely unrealistic given your actual limitations, local job market, age, or specialized work history. Carriers use these vocational opinions to justify terminating benefits, arguing that you’re capable of some form of work even if no employer would actually hire you, given your restrictions.

What to Do When Your Benefits Stop or Change

If your LTD benefits are terminated, reduced, or subject to new demands in January, take these steps immediately:

- Don’t Panic, But Don’t Delay: You typically have limited time to appeal a benefit termination—often just 180 days under ERISA-governed plans. Missing appeal deadlines can permanently forfeit your rights.

- Request Your Complete Claim File: Under ERISA, you’re entitled to receive all documents the carrier relied upon in making its decision, including medical reports, vocational assessments, surveillance footage, and internal communications. Review this file carefully or have an experienced attorney review it for you.

- Gather Supporting Documentation: Obtain detailed letters from your treating physicians explaining your functional limitations, how your condition prevents you from working, and why you cannot perform the jobs the carrier has identified. Medical opinions from treating physicians who have followed your case over time carry significant weight.

- Document Everything: Keep detailed records of all communications with your insurance carrier, including dates, names of representatives, and summaries of conversations. Maintain daily activity logs that accurately reflect your limitations and symptoms.

- Consult with an Experienced Disability Attorney: LTD claims involve complex policy language, medical evidence, vocational assessments, and procedural requirements. An attorney experienced in disability insurance can evaluate your claim, identify weaknesses in the carrier’s decision, and build a compelling appeal.

How Kantor & Kantor Can Help

For over 45 years, Kantor & Kantor, LLP has exclusively represented individuals in disputes with insurance companies. We’ve handled thousands of long-term disability claims and understand the tactics carriers use to deny, terminate, or reduce benefits—particularly during January reevaluations.

Our experience includes:

- Challenging improper benefit terminations and demanding reinstatement

- Appealing denied claims with comprehensive medical and vocational evidence

- Negotiating offset disputes and overpayment demands

- Representing clients in ERISA appeals and litigation

- Handling claims under both ERISA-governed group policies and individual disability policies

We represent clients throughout California and nationwide. Whether you’re facing a benefit termination or reduction, or have questions about a January reevaluation notice, we provide experienced guidance tailored to your specific situation.

5 Long-Term Disability Insurance FAQs

Q: My LTD benefits were just terminated after two years. Why did this happen?

A: Most group LTD policies change the definition of disability after 24 months. Initially, you qualify for benefits if you cannot perform your “own occupation”—the job you were doing when you became disabled. After 24 months, many policies switch to an “any occupation” standard, requiring you to prove you cannot perform any job for which you’re reasonably suited by education, training, or experience.

Q: The insurance carrier wants me to attend an Independent Medical Examination (IME). Do I have to go?

A: Generally, yes. Most LTD policies include provisions requiring claimants to submit to medical examinations requested by the carrier. Refusing to attend may result in termination of benefits. However, you have rights during this process. You can typically have someone accompany you to the examination, request that it be recorded, and provide the examiner with relevant medical records.

Q: My carrier says I was overpaid and owes them thousands of dollars. What should I do?

A: Don’t immediately accept the carrier’s calculation. Overpayment claims often result from errors in offset calculations, miscommunication about SSDI benefits, or the carrier’s failure to properly account for previous payments. Request a detailed breakdown showing exactly how they calculated the overpayment, including dates, amounts, and the basis for each offset. Compare this to your own records of payments received and benefits from other sources.

Q: Can the insurance carrier hire someone to follow me and videotape me?

A: Yes. Insurance carriers routinely conduct surveillance of disability claimants, and this practice is generally legal. Private investigators may videotape you in public places, document your activities, and monitor your social media accounts.

Q: How long do I have to appeal if my LTD claim is denied?

A: For ERISA-governed group disability policies (most employer-provided plans), you typically have 180 days from the date of the denial letter to file an appeal. Some policies provide longer periods, but 180 days is standard. This deadline is strictly enforced—if you miss it, you may permanently lose your right to challenge the denial.

Contact Kantor & Kantor, LLP

If your long-term disability benefits have been terminated, reduced, or are under review, don’t face the insurance carrier alone. Contact Kantor & Kantor, LLP for experienced legal representation. We’ve been fighting for disability claimants for over 45 years, and we know how to hold insurance companies accountable.

Call us today for a consultation. We represent clients throughout California and nationwide.